How Ecommerce Experts Use Contribution Margin to Maximize Profit

Learn what contribution margin is, how to calculate it for eCommerce, and how to practically apply those insights to maximize your business profitability.

Profit analysis is a long journey, and like any journey, it's full of checkpoints you can’t afford to miss. Each one tells you if you are on the right path, managing your expenses, and if you are heading toward your actual profit.

Most merchants go from gross profit straight to net profit, without stopping to measure what happens in between, and they end up in trouble, because they skipped a crucial checkpoint.

It’s your contribution margin. When you subtract ad costs from gross profit, you get your contribution margin. Ignoring it is like driving past a flashing warning light. It tells you whether your ad strategy is sustainable.

If your ad costs are too high, then a large chunk of your gross profit gets consumed by those costs. This leaves you with a low contribution margin that doesn’t just make it hard to cover your operating expenses, but leaves you with little or nothing to keep as net profit. Not to mention, you can’t make great sales without advertising.

In this blog, we’ll break down why it matters, how to calculate it, and how it can reshape the way you spend on your ads and analyze your profits.

The Common Misconception: Contribution Margin is not what you think

Don’t mistake contribution margin for gross margin or profit margin. In fact, gross profit sets the stage for understanding your contribution margin.

While these metrics might be closely related, they are divided by thin lines. Here’s a close comparison for clarity:

But here’s the thing! As you can see here, your contribution margin cannot be understood in isolation. It only makes sense when viewed in relation to your gross profit and net profit.

Now that we’ve cleared up the route, let’s take a closer look at how contribution margin guides your ad spending and helps you make smarter, more profitable decisions.

How Do You Calculate Your Contribution Margin?

Let’s break it down:

Contribution Margin = Revenue – COGS – Ad spend

Where,

Revenue is the total income you earn from selling your products, before any costs are deducted.

COGS is the direct cost incurred in procuring or producing your product

Ad spend is the total amount spent on marketing to acquire customers.

Calculating your contribution percentage helps you see whether your ad costs are actually helping or hurting your net profit.

Why Contribution Margin Matters More In Every Pricing Decision

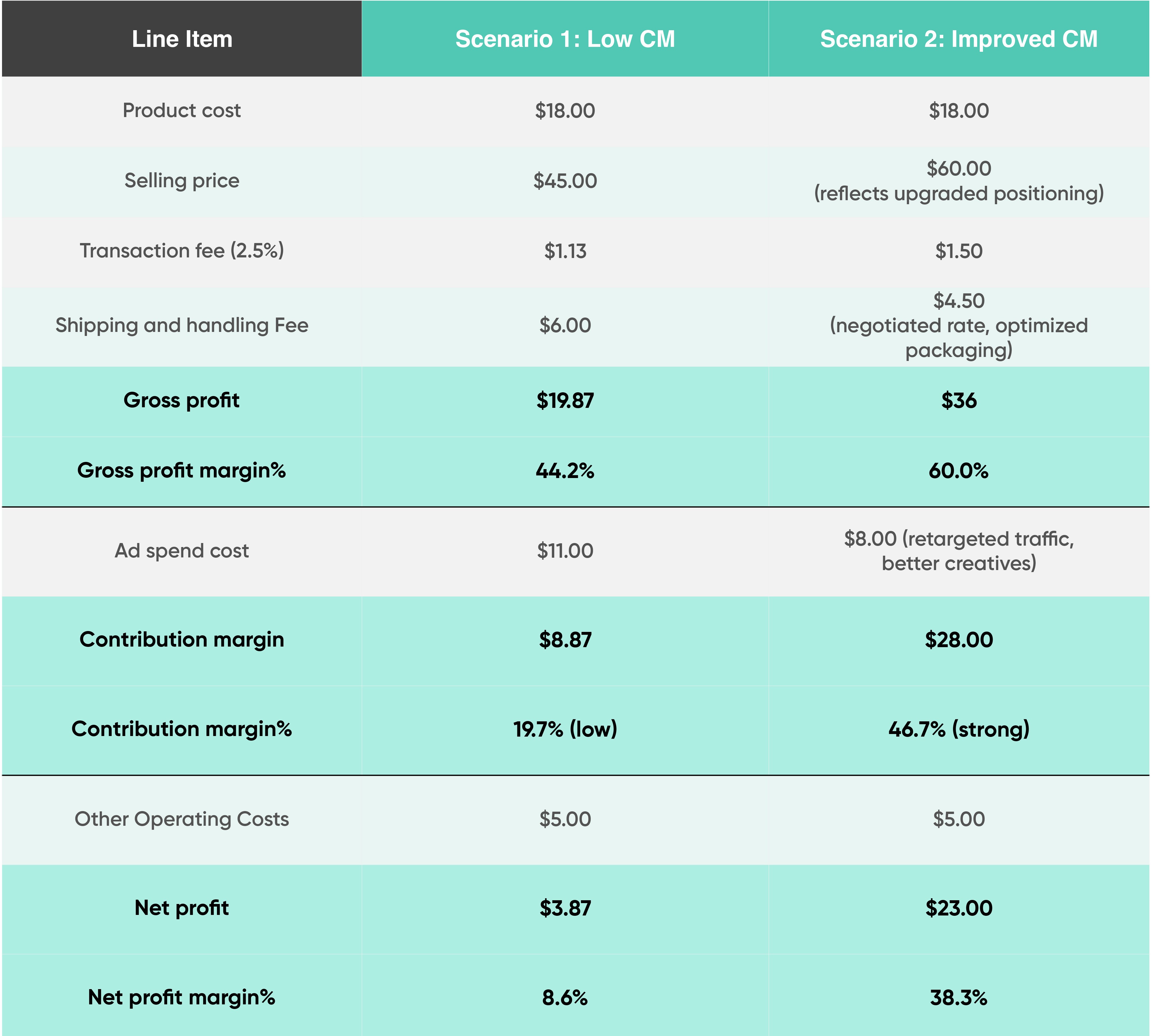

Say you're selling a premium insulated coffee tumbler with a unit cost of $18.00. Here's a full breakdown of how it performs across your key profitability metrics.

If you are analyzing profits only based on gross profit, the product seems profitable and scalable, as you are earning nearly $20 per sale (scenario 1). But that illusion fades fast once you factor in ad costs, exposing just how weak the contribution margin really is.

So, how do you know when you can sell profitably with ads?

That's where Breakeven ROAS (BEROAS) helps. BEROAS is the minimum return on ad spend you need to avoid losing money. You can calculate it as:

BEROAS = Selling price ÷ (Selling price – COGS)

Once you calculate your BEROAS, you use it as a target to compare your actual ad performance. Here’s how it works

If your actual ROAS > BEROAS, you're making a profit.

If your actual ROAS < BEROAS, you're losing money on every sale.

If your actual ROAS = BEROAS, you’re just breaking even.

To fix it, you can reduce ad spend, lower variable costs, or increase the product's selling price, if feasible.

Now let’s see how a few simple tweaks to your pricing, packaging, and ad strategy can turn that low contribution margin (from the earlier example) into a strong, sustainable profit.

How Pricing and Cost Decisions Help Improve Contribution Margin?

1. Reduced Ad Spend by $8.00

Focused ad spend on high-intent buyers to lower CAC, reduced costs by cutting creatives and agent fees, and re-engaged users with higher purchase likelihood.

2. Lowered Shipping & Handling by $4.50

Negotiate better courier rates, optimize packaging, and bulk-ship to save on shipping costs. Every dollar saved improves the contribution margin.

3. Raised selling price to $60

Increase product value and demand by promoting design, insulation quality, or brand appeal, justifying premiums within market standards.

The result? A 46.7% boost in contribution margin, more than enough to cover your $5 operating expense and still leave you with a healthy $23 in actual profit on an $18 product.

Makes sense now, doesn’t it? This is how you should’ve been looking at your profit all along.

What is a Good Contribution Margin?

While there’s no fixed rule, a general pattern observed across successful stores shows a contribution margin above 50% to be healthy, given it allows room to increase ad spend, cover fixed costs, reinvest in inventory for future growth, and still maintain profit.

The ideal margin typically depends on your business model, company life cycle, product category, and customer acquisition strategy. For example, if you are in the early stages of your business and are focused on market share and growth, you might want to sacrifice contribution margin (by spending more on ads) for acquiring new customers.

The bottom line is, the higher your contribution margin, the better!

Why Improving Your Contribution Margin Pays Off

As we’ve discussed, contribution margin isn’t a metric you can compromise on. And in e-commerce, neither is advertising, especially after you understand how it influences your profits. Most don’t see it coming, and when ignored, it leads to overspending on ads, causes your profits to drop, and ultimately leaves you with less net profit in the end.

Tracking contribution margin helps you set better ad budgets, find where profits are slipping away, adjust quickly when sales dip or unexpected costs hit, and make smarter pricing and marketing choices to protect your bottom line. And optimizing at this checkpoint will ultimately boost your net profit.

Thankfully, these are costs you can control if you have the right tools. So, next time, don’t just speed past this checkpoint. Stop, analyze, and make decisions that help you keep more of what you earn.

FAQ

What's a good contribution margin for ecommerce?

The ideal contribution margin depends on your business model and how you operate. The closer to 100%, the better. But, most successful ecommerce brands maintain at least a 50% margin to grow sustainably.

Is contribution margin the same as gross profit?

No.

Gross profit shows how much you keep after subtracting the product cost (COGS) from your revenue.

Contribution margin shows how much of that is left to spend on ads and cover fixed costs like rent and salaries.

What does a higher contribution margin mean?

The higher your contribution margin, the better you are at optimizing your ad spend, reinvesting in inventory for future growth, covering fixed costs and still maintaining a healthy net profit.

What is the formula for contribution percentage?

The formula for contribution margin percentage is:

Contribution Margin % = ( Revenue – COGS – Ad spend ÷ Revenue ) × 100

What is a bad contribution margin?

A bad contribution margin, typically below 30%, makes it hard to scale or stay sustainable.