Measuring and Analyzing Order-Level Profits in Shopify

Learn how to calculate Shopify order-level profits and gain practical insights to optimize costs and boost store profitability.

A high number of orders can boost revenue. But, are those orders really contributing to the net profit? You can’t be sure unless you’re seeing the true cost mix at the order level

It’s not always an oversight when an order becomes far less profitable than expected. Sometimes it’s the choices you make about sales, fulfillment, or markups. Other times, it’s factors beyond your control, such as fluctuating costs and shifting trends that reduce profit per order.

That's why it's important to keep a close eye on how profit is trending at the order level, and how every cost tied to that order impacts overall profitability over time. To find the true profit margin of an order, you need to dig up all the line items that are directly connected to it.

Here is a quick read to help you see how to calculate order-level profits and why having this insight will give you the control to make informed decisions around order pricing and scaling.

Calculating Order-Level Profitability

The products may carry strong margins individually, but once they become part of an order, they can generate weak or even negative order margins. Because, inside an order you deduct multiple cost components: discounts, refunds, product costs, and fulfillment expenses (shipping, handling, tariffs, and payment fees). Sometimes, the remaining profit isn’t enough to cover those order-level expenses, which pushes the order margins down.

Calculating order-level profits shows whether each sale actually contributes to your bottom line after every cost is accounted for. Once you can clearly measure profit at the order level, you get to see which line items are dragging margins down and how prices, fees, or policies need to be adjusted to keep orders consistently profitable.

So how do you actually calculate order-level profit? Let’s walk through the full breakdown.

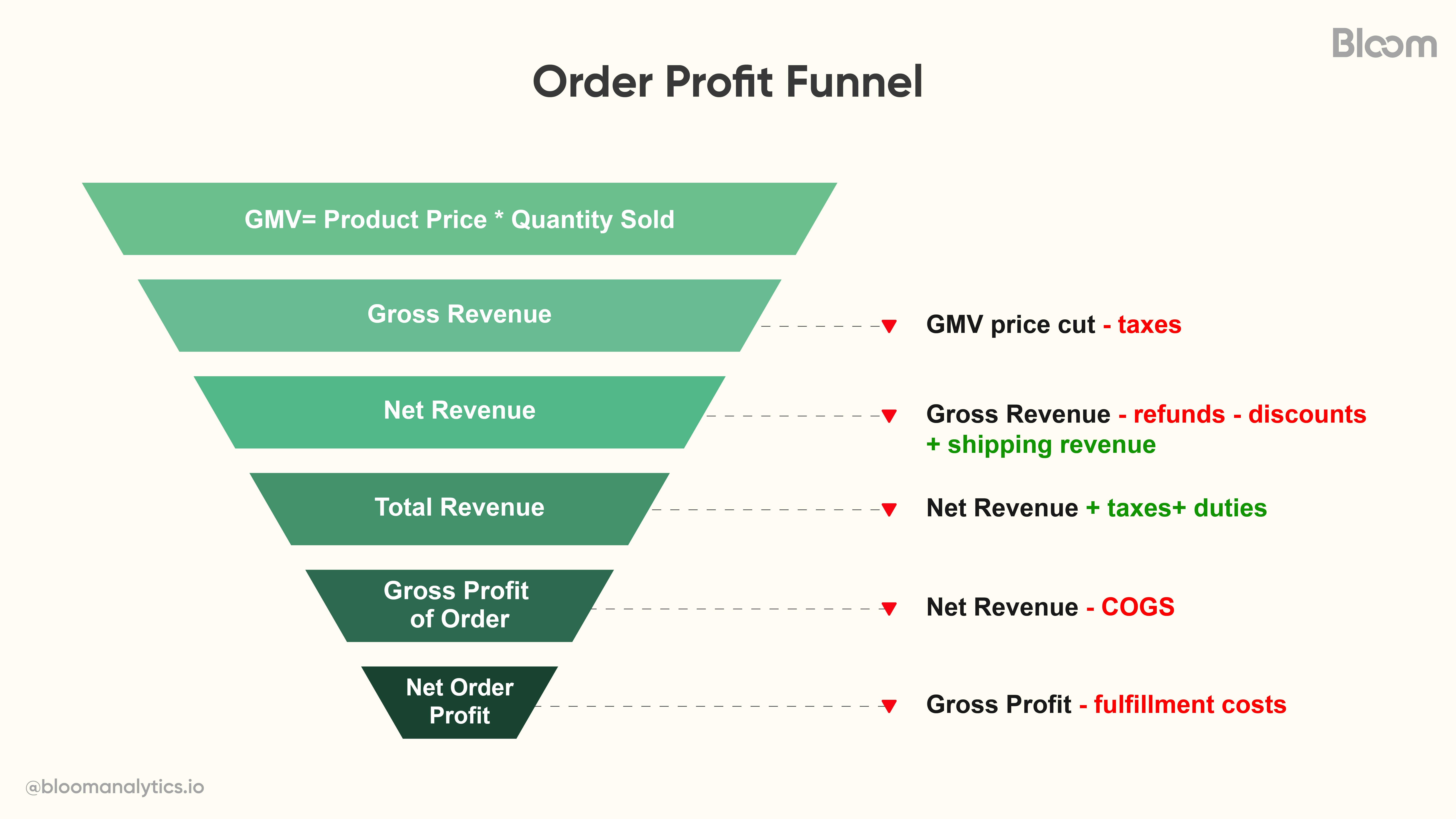

GMV= Product Price * Quantity Sold

Gross Revenue = GMV - Price cut - Taxes

Net Revenue = Gross Revenue - Refunds - Discounts + Shipping Revenue

Total Revenue = Net Revenue + Taxes+ Duties

Gross Profit of Order = Net Revenue - COGS

Net Order Profit = Gross Profit - Fulfillment Costs

Now, let’s look at each component in detail and see how it influences your order-level profitability.

Key Components of Order Profit Calculation

Gross Merchandize Value (GMV)

We start here. That big, exciting number which makes every dashboard look good.

GMV is the real sales volume before any deductions.

(i) To find the GMV of an order, calculate GMV of each product individually using the formula:

Gross Merchandise Value = Sales Price of Goods x Number of Goods Sold

(ii) Then add them together.

For example,

GMV of product one 1:2 x $30 = $60

GMV of product 2:1 x $20 = $20

GMV of product 3:1 x $19 = $19

GMV of an order= $99

Gross revenue

Of course, that excitement holds up only until the deductions start rolling in.

From GMV, we deduct any reductions applied at the product or line-item level, and subtract taxes if they were included in the product price/collected on the entire order value.

Gross Revenue = GMV – price cut – taxes

Net Revenue of an Order

Watch out for the biggest margin killers here!

Refunds and discounts are deducted, and any customer-paid shipping is added back in. If not tracked carefully, discounts and refunds can significantly impact the margins.

Net Revenue = Gross Revenue - Refunds - Discounts + Shipping Revenue

*Refunds – Include all types of refunds tied to the order: full refunds, partial refunds, chargebacks, and any refunded shipping charges.

*Discounts – Not all discounts are applied the same way. Some discounts are applied to the entire order (cart-level), some to specific products, some through offers like Buy One Get One, and others through codes like free shipping. Include all of them when calculating gross profit so you get a realistic picture of how much you can afford to discount without hurting your margins.

*Shipping Revenue – Add the shipping amount paid by the customer for that order. This increases the order’s revenue.

*It’s important to get Net Revenue right, because it becomes the starting point for all remaining cost deductions.

Total revenue of an order

Here we add taxes and duties back, only for reporting them in the dashboard

Total Revenue = Net Revenue + Taxes + Duties & Tips

🚩Tax, duties and tips collected are paid back to government by the business and don’t contribute to profit, so they’re excluded from all further calculations.

Now, let’s see what the contribution margins reveal.

Gross Profit of Orders

So, how much does COGS take?

The viability of product pricing choices becomes evident here.

Gross Profit (CM1) = Net Revenue – COGS

where COGS = Sum of product costs within the order

*COGS can fluctuate, but Shopify updates those changes automatically. If you ever need to adjust a cost manually, you have the option to custom-add it.

Contribution Margin or the Net Profit of Order

Coming to the last set of expenses: fulfillment costs.

This step defines your net order profit, or simply, how much the order truly contributes after all expenses.

CM2 = Gross Profit - Fulfillment Cost

Where, Fulfillment cost = Shipping, Handling, Tariff, Payment Processing Fees

*Shipping and handling costs can fluctuate based on different order sizes, weights, zones, and carriers.

*Payment processing fees can vary based on the order amount.

Now you know how costs are grouped and analyzed. But what can go wrong in orders?

Common Margin Killers You’ll Discover at Order Level

Over Discounting

Shipping cost overruns

High return/refund frequency

Payment processing fee spikes

Heavy/bulky product penalties

Bundles that erase profit

How to use order-level insights to your benefit

Use order-level insights to fix these margin killers and protect the margins around:

Pricing

If order revenue cannot absorb higher payment fee, shipping, handling, discounts, or refunds, spice up your selling prices a bit

Remove SKUs that never contribute positively, or bundle them with high-margin items so the stronger item evens out the weaker one.

If the problem is high product cost, renegotiate vendor pricing or switch to someone a bit more friendly with your wallet.

If nothing fixes the product’s margin, phase it out.

Discounting

Offer discounts only on profitable order patterns.

Set discount limits; for example, “only discount when margin stays above X%.” This ensures every offer still leaves room for profit instead of blindly reducing revenue.

Shipping Strategy

Set minimum order rules so only profitable carts qualify for free shipping or special offers.

Don't just charge people a flat rate for shipping - make it depend on zones, weight, and carrier rates, so you don’t undercharge.

Negotiate better rates with your carriers, or switch to a more reasonable one if you have to.

Adjust shipping methods, so you don't spend a fortune on fast delivery unless people actually need it.

Fulfillment Optimization

Get lighter on the packaging to reduce weight charges.

Choose carriers based on which ones do the best job in the cheapest way possible.

Payment Processing Fees

Offer discounts for cash or lower-fee payment methods to save margins from sudden processing fee spikes

Consider minimum order values to ensure higher fees don’t take up your profits.

Refund Costs

Identify products with high refund or return rates.

Fix quality issues or improve descriptions to reduce mismatched expectations.

Offer exchanges instead of refunds to retain revenue whenever possible.

Conclusion

Order profit analysis helps you measure how much profit you make from each individual order, helping you invest wisely on sales that take your business forward. It breaks down every cost that goes into a sale, so you can see exactly where money's going, and fix those sneaky cost drainers as early as possible.

But doing this manually gets messy fast, especially when you’re dealing with hundreds of orders and costs that change all the time. Trends can flip overnight, leaving you guessing major cost decisions.

It’s best to switch to a system that pulls all your order-level costs together and calculates net profit automatically. You get instant clarity, real-time numbers, and a much simpler way to spot issues and act on them before they hit your margins.